Acquisitions are like trying to grow mushrooms and the results are seldom worth it! Businesses have a personality—a unique culture. Even though a merger of two companies may appear to make financial success, the clash of cultures often damages both organizations. There is a long-standing joke about being acquired. It is like being a mushroom. First, they put you in the dark. Then they dump manure on you, and finally they can you. Unfortunately, there is a truth to the joke. Because eliminating people is the easiest way to cure the clash of cultures.

Even if an acquisition could be limited to acquiring a customer base, the square-peg-round-hole problem will still exist. The acquiring company finds that its efforts are redirected to assimilating clients who have chosen the acquired company’s products or services for reasons that probably differ from the reasons your customer chose you. Their customers have different expectations and have relationships with the team of the acquired company that will be disturbed. More than likely, terms and prices will be different and must be blended together. It is likely that promises or expectations will complicate assimilation. Any way you cut it, resources and energy become redirected.

The Encore expectation of the public often drives companies to play the acquisition game. The encore expected, if not demanded, is for companies to achieve successively higher results. Acquisitions usually follow a repeated pattern. The acquiring company consolidates operations by shedding people, which pushes profits up; however, over time the square-peg-round-hole disruption results in client/customer loses and declining profits. The acquirer makes another acquisition to achieve its expected successively higher results. Eventually the house of cards collapses.

One of the problems with “going public” is that the now-public company has a lot of cash and shareholders who expect that cash to be put to profitable use. The now-public company has little choice other than using its war chest to grow through acquisition. That in turn changes the nature of the business that attracted the new shareholders in the first place. Not all acquisitions are bad. Some are necessities. But generally speaking, they are high-risk low-return alternatives for growth. The only advantage they offer is immediacy but that immediacy comes with speed bumps that, in the long run, slow you down.

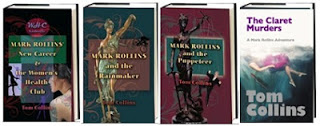

On June 7th I will be in Fort Lauderdale at the BIG Breakfast event discussing my in-process book on Business Management and Leadership. The title is still up in the air, but I’m leaning toward Business Journey or Managing @ the Speed of Sight! Input is welcome. I will be signing copies of The Claret Murders and previous Mark Rollins adventure mysteries at the Vanderbilt Barnes and Noble in Nashville Tennessee on June 22nd ... more details to follow.

Even if an acquisition could be limited to acquiring a customer base, the square-peg-round-hole problem will still exist. The acquiring company finds that its efforts are redirected to assimilating clients who have chosen the acquired company’s products or services for reasons that probably differ from the reasons your customer chose you. Their customers have different expectations and have relationships with the team of the acquired company that will be disturbed. More than likely, terms and prices will be different and must be blended together. It is likely that promises or expectations will complicate assimilation. Any way you cut it, resources and energy become redirected.

The Encore expectation of the public often drives companies to play the acquisition game. The encore expected, if not demanded, is for companies to achieve successively higher results. Acquisitions usually follow a repeated pattern. The acquiring company consolidates operations by shedding people, which pushes profits up; however, over time the square-peg-round-hole disruption results in client/customer loses and declining profits. The acquirer makes another acquisition to achieve its expected successively higher results. Eventually the house of cards collapses.

One of the problems with “going public” is that the now-public company has a lot of cash and shareholders who expect that cash to be put to profitable use. The now-public company has little choice other than using its war chest to grow through acquisition. That in turn changes the nature of the business that attracted the new shareholders in the first place. Not all acquisitions are bad. Some are necessities. But generally speaking, they are high-risk low-return alternatives for growth. The only advantage they offer is immediacy but that immediacy comes with speed bumps that, in the long run, slow you down.

# # #

On June 7th I will be in Fort Lauderdale at the BIG Breakfast event discussing my in-process book on Business Management and Leadership. The title is still up in the air, but I’m leaning toward Business Journey or Managing @ the Speed of Sight! Input is welcome. I will be signing copies of The Claret Murders and previous Mark Rollins adventure mysteries at the Vanderbilt Barnes and Noble in Nashville Tennessee on June 22nd ... more details to follow.

Mysteries by Tom Collins include Mark Rollins’ New Career, Mark Rollins and the Rainmaker, Mark Rollins and the Puppeteer and the newest, The Claret Murders. For signed copies go to http://store.markrollinsadventures.com. Print and ebook editions are available from Amazon, Barnes & Noble and other online bookstores. The ebook edition for the iPad is available through Apple iTunes' iBookstore.